made

for a happy day

UK house price crash - quiet before

the fall (2007)

There is an uncomfortable quiet right now. Like in the film Zulu,

it is the quiet just before the embattled British soldiers catch sight

of a massed army rising up across the horizon. It's the quiet before the

fall.

Of course, I hope I'm wrong on this, but for some UK residents the battle

for financial survival appears to have already begun. Of 179 properties

recently up for auction in Covent Garden, 52 were repossessions.

The Financial news of the last 8 weeks adds little cheer. Banks have stopped

lending to each other. Investors aren't buying up commercial debt. There's

a rush to sell investments in house-builders, commercial property funds

and any mortgage lenders suspected of being exposed to subprime loans.

In fact, a recent survey finds confidence in the UK financial sector at

its lowest since 1990 - the time UK house prices last went into freefall.

We've just seen the first run on a British bank since the 1800s. Queues

of anxious savers were kept waiting outside Northern Rock branches. Then

the contagion. Both Alliance & Leicester and Bradford & Bingley

took hits on their share prices . Even Barclays looks to be feeling the

heat.

Up on the horizon stands a looming threat - the end of 2-3 year fixed

rate mortgage deals. This means that 2 million UK households are about

to be hit with 7.5% interest on their loans - this at a time when our

personal savings are at a 47 year low and already twice as many Brits

are missing mortgage repayments as in 2006.

A cause for concern? 60% of the UK's wealth is now said to be tied up

in housing, so the dramatic increase in speculative buy-to-let ownership

(up by a factor of at least 33 in the last 10 years) doesn't inspire confidence.

Following a series of interest rate hikes, landlords now find that rental

incomes have fallen below their own mortgage repayments. This is forcing

landlords to sell. Brand new buy-to-let flats up North can already be

found being auctioned off at 60% of the price they were bought for in

2006.

Record numbers of Brits are now seeking debt advice. In London, where

property prices peaked at 15 times average earnings, some young couples

are spending a barely conceivable 50% of their post-tax income on mortgage

repayments.

We should be worried. All this suggests to me that talk of a 1989 style

house price correction would actually be to understate how bad today's

bust could be. Our disposable income has fallen below 1990 levels under

a mountain of debt. Outstanding household loans currently stand at £1.3

trillion in the UK, double the outstanding debt just 7 years ago.

That's a lot of money to pay back, particularly when people find themselves

with negative equity. At minimum, rational homeowners with interest only

mortgage deals might be tempted to hand back the keys. If this happens,

it may force banks to auction off properties for whatever they can get

for them... further depressing prices.

But the inevitability of falling house prices isn't the whole story. According

to the Memorandum of Understanding between the government and the Bank

of England, the Chancellor's bailout of Northern Rock should only have

happened if the bank's troubles constituted "a genuine threat to

the stability of the financial system".

Therefore, taking the Chancellor's actions at face value, it tells us

that the entire banking system is in a jam. It's a lot more serious than

a few borrowers, banks and shareholders getting their fingers burned.

So how should we be preparing for the worst?

Firstly, we need to recognise that now really isn't the time to be buying

a house or taking on debt. If you stick to renting you won't feel hard

done by or under siege should you see house prices falling and interest

rates continuing to rise (as Alan Greenspan just predicted, incidentally).

Secondly, things could get really bad, like losing your job bad. It's

a sobering thought. But look around. Jobs are already being shed in the

financial and building sectors. The retail sector is also worried about

what domestic belt tightening will mean for Christmas sales. Have a plan

B.

Thirdly, the demand for cash isn't about to dry up. If the banks are crying out for cash today, you can bet that the rest of us will be crying out for it tomorrow. Make sure you can lay your hands on enough of it.

Ends | 5 Oct 2007 | The Leg

comment

| back to top

| thoughts

Essential Reading:

UK financial crisis 2007 | 2008.

Where to next?

Related viewing:

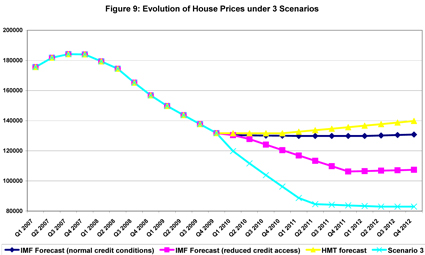

Graph: 3 possible scenarios for the future movement of UK house prices

suggested by the New

Economics Foundation. Click image to enlarge.

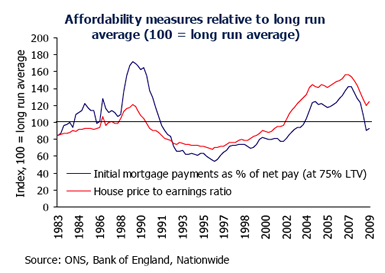

Graph: Nationwide's affordability index suggests the house price to earnings

ratio is still at a historically unsustainable high.

Related Articles

2013:

Ireland:

Bleak houses

2012:

Aug:

Halifax index says house prices have fallen 20% in 5 years

Jun:

Net mortgage lending falls for first time in 15 years

Adamstown - empty

new town near Dublin where prices down 57%

May:

London prices hold up, elsewhere prices falling steeply

Real

risk of mortgages becoming unaffordable when base rate rises

2011:

Average

UK house price is down 2.5% year on year in July

Why

US real estate may stay weak for another 10 years - will UK follow?

Shelter

maps repossession hot spots - Corby, Barking, Daganeham....

February:

UK house prices fall for fifth time in six months

2010:

Construction

in Central London falls to lowest level in 20 years

Nationwide

reports 0.7% house price fall in October

September

mortgage lending slumps to lowest level in a decade

Halifax

reports 3.6% house price fall in September - biggest drop since '83

State

safety net for homebuyers who lose jobs cut back

UK

house repossessions climb to 46,000 in 2009, highest in 14 years

2009:

16

Oct: Banker's bonus expectations lift interest in prime homes

27

Aug: Weak pound creating demand for London prime homes?

21

Aug: Japanese land prices are 58% below their 1991 peak

14

Aug: B&B repossessed 50% more homes in 1st 6 mths of '09

19

July: Government: av. house price fell 12.5% in year to May

8

July: Help for movers stuck due to potential losses on property

22

June: Negative equity traps 1 in 10 UK borrowers

20

May:House buyers negotiating 6.5% discounts on asking price

15

May: 12,800 UK homes repossessed in Q1

13

May: Land Securities' portfolio fell in value by a third in 08/9

12

May: Available buy-to-let mortages just fell by 95% in 2 years

6

May: House price falls by region to Q1 09 - from the Halifax

30

Apr: Oversupply of flats has resulted in falling rents

3

Apr: Banks start to pile pressure on buy-to-let portfolio holders

26

Feb: Nationwide: house prices down 18% in 12 months

25

Feb: Fall in rents as unsold home flood the market

21

Feb: 40,000 repossessions in 2008, up from 25,900 in 2007

13

Feb: Number of UK house buyers the lowest for 35 years

1

Feb: Lenders demand 50% deposit for mortgage on a new flat

30

Jan: Housebuilders offer frenzy of freebies to attract buyers

6 Jan: Nationwide:

UK house prices fell 15.9% in 2008

2008:

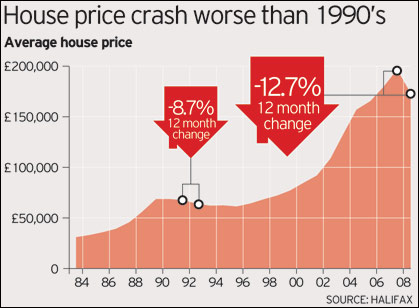

Graph: Halifax's statistics, September 2008

'talk of a 1989 style house price correction would actually be to understate

how bad today's bust could be'...

Dec:

Bailiffs get power to use force on debtors

Dec:

Estate agent jumps on sale bandwagon

Dec:

Last month house prices fall at fastest pace in 25 years

Dec:

UK's construction sector shrinks at fastest pace on record

Nov:

New Star property fund shares just fell 94% in 12 months

Nov:

11,300 UK home repossessions in Q2

Nov:

RICS warn of mounting oversupply of rental properties

Nov:

Taylor Wimpey has lost 98% of its share value in 12 months

Nov:

650,000 buy to let properties standing empty in the UK?

Nov:

Average interest on UK tracker mortgage in Oct was 6.84%

Nov: UK house prices reported to be falling by £900 a week

Oct:

Nationwide: UK house prices 14.6% lower than year ago

Oct:

UK home repossessions up by 71% as unemployment soars

Oct:

1.2 million face negative equity in UK

Oct:

Nationwide: UK house prices 12.4% lower than year ago

Oct:

Barratt deal: 43% discount when you buy 5 flats or houses

Sep:

Halifax - UK house price have fallen 12.7% in 12 mths

Aug:

Nationwide - UK house prices have fallen 10.5% in 12 mths

UK

estate agents are selling just one property a week

Nationwide:

average house £17,000 cheaper than 12 mths ago

UK

developers offer 25% of new house value free for 10 years

UK

house price decline is now swifter than the crash of '89

New

build flats selling at 45-50% of 2006 price at auction

Brown

Adviser believes UK house prices won't recover until 2015

House

sold in 3 mths to June almost a third lower than year ago

Property

index anticipates 50% fall in UK house prices to 2011

Buy

to let mortgage reset could make landlord's costs leap 36%?

House

prices sliding faster than in 1990s recession

A

sign that the buy to let boom is over

Negative

equity hits 250,000 in UK while mortage costs rise again

Nationwide

reports 2.5% fall in UK house prices in May

First-time

buyers spend half of income on mortgage

Council

of mortgage lenders foresees 7% fall in prices in '08

Average

rate for 2 year mortage now at 6.64% vs 4.34% in 2006

95%

of UK surveyors reported falling house prices in April

May:

Reposssession orders up 16% vs 12 months ago

Nationwide:

average house £7500 cheaper than 6 mths ago

Up

to 33,000 borrowers expected to lose homes this year

More

houses for sale than there are buyers over last 3 months

Surveyors

report widespread house price falls in March 08

House price falls reported by

chartered surveyors March 08

"had

no idea idea how difficult it would be to sell this house"

Prices

falling in half of postcodes of England and Wales

Halifax

reports biggest monthly drop in house prices since 1992

Will

lowered capital gains tax trigger buy-to-let sell-off?

1.25%

added to average new mortgage offer in last 9 months

Spain:

40k Estate Agents close, developers unable to refinance

Florida:

Bargain hunters hop on foreclosure express

Average

annual mortgage bill now £1464 more than 2 yrs ago

Nationwide

raise interest on two year tracker mortgage to 7.1%

Nationwide

survey reports fifth monthly fall in UK house prices

Miami:

House prices have now fallen 19% in last 12 months

Manchester:

Repossessed flats sold for 50% of 2005 price

Failure

to keep up card repayments could cost your home

Falling

house price valuations & tighter credit block remortgaging

Remortgaging

is going to seem expensive now

44%

of net salary spent on mortgage, up from 34% 5 years ago

35%

more people asking CAB for advice on mortage arrears

UK

lenders cancel mortgage deals with just 10 minutes notice

UK

Housebuilder Bovis' order books are down 20% in 2008

RICS

surveyors report similar rate of house price falls to 1990

Buy-to-let

investment firm to end seminars and make staff cuts

2

in 100 mortgage borrowers in the US are losing their homes

US

house owners hand back the keys as cheap rates end

Recession

and repossession - surviving a great fall

European

house price gains are starting to fade

Miami:

In just 12 months, house prices have fallen by 17.5%

US

house prices may still fall 25%, losing gains since 2000

What

happens when a million amateur landlords get cold feet?

Nationwide

survey reports fourth monthly fall in house prices

Those with 125% mortgages won't be able to refinance them

100%

loans no longer an option for those (re)mortgaging now

Labour

raked in £31bn in stamp duty over the past ten years

Not

enough young urbanites to buy or rent all these new flats

7.3%

of outstanding US mortgages in default, 4% in arrears

UK

home reposessions rise by 21% to highest since 1999

£1.4bn

wiped off the value of British Land's property portfolio

Average

US house prices set to fall at least 25% further

Nationwide

survey reports third monthly fall in UK house prices

Surveyors

predict 123 homes a day will be repossessed in 2008

What's

your Plan B if you get made redundnant?

Spectre

of negative equity haunts Britain

Downhill:

more surveyors are seeing price falls than price rises

Families

face mortgage bills 20% higher than 2 years ago

Spain:

shares in 2nd largest property firm fall 40% in 2 days!

House

Prices fell 30% in a few years after 1948, 1979, 1988...

Graph: Over the cliff? % month on month increase/decrease in house prices

in the UK.

Graph: Relative increases in house prices in Great Britain, France and

the US since 1970. Note the precarious position of the UK where prices

are much more over-inflated than elsewhere.

2007:

Landlords

face office rent crisis in 2008

How

low will it go?

Nationwide

survey reports second monthly fall in house prices

UK

house prices fall again this month - as does job security

Friends

Provident suspends withdrawals from property fund

UK

commercial property prices have already fallen by 10%

Growing

numbers of landlords selling as rental contracts end

"A

thousand flats lie empty in Leeds..."

40%

of UK mortgage products have disappeared

US:

5.5% of homeowners are late with mortgage repayments

Crashing

back to 1991

Funds

which insure US mortgage repayments coming unstuck

Halifax

reports 1.1% fall in house prices during November

Crash

that 'won't happen here' looms large

663,000 UK homes (3% of all

dwellings) stood empty in 2006

Mortgage

arrangement fees double from £441 to £827 in 2yrs

Nationwide:

average house price fell by 0.8% in November

Building

materials supplier sheds 6000 jobs as US profits slide

1

in 3 UK mortage holders 'will suffer financially'

City

bets on 7% fall in UK house prices in 2008

House

price crashes usher in, rather than follow, hard times

95%

mortgage @ 6.5% fixed rate may mutate to 80% @ 9.5%

Safety

net which reduced 1990's repossessions is not there

Monthly

mortgage approvals sink to lowest in at least 10 years

UK

savers pour millions into 'safe haven' Nationwide

21

Nov: UK interbank lending rate hits 2 mth high of 6.49%

Over-supply

in buy-to-let sector sees developers delay building

Buy-to-let

specialist Paragon may have to stop trading

UK's

biggest agent hit by number of sales falling through

5%

of borrowers spend 50% of gross salary on mortgages

Nationwide:

house prices will fall across much of England in 2008

British

Land eyes up 'distressed' sellers

Surveyors

report house price drops of 8pc in 3 mths in N.Ireland

Life

just got harder for those that have to borrow to buy

Shares

of UK's top 7 housebuilders dropped 42% since April

Council

of Mortgage Lenders predicts 50% rise in repossessions

Fred

Harrison on House Prices: "Expect the worse"

Property Snake maps downward trend in UK asking prices

UK

all set for a crash. 2m in USA may lose homes

UK

house prices fell in October, even in expensive areas

As

fixed rates reset, mortgage approvals fall to 7 year low

Repossessions in

Wales are set to go on rising

18

Oct: 'Unusually high stock level...unusually low buyer levels'

Vulnerable

are using credit cards to cover mortgage or rent

IMF:

UK house prices overvalued ... by as much as 40%

Vulture

fund will prey on 'distressed assets or forced sellers'

Panorama:

Sub-Prime Suspect reveals mis-selling of mortgages

Fire

sales of assets on the way?

What's spooked the fat controller?

A

quarter of UK first time buyers can no longer afford to buy

Fall

in UK house prices now may hit harder than crash of 1990s

Halifax

says UK house prices fell by 0.6% in September

Buy

to let flats in UK being auctioned for 60% of original price

Landlords

find rental returns falling below mortgage repayments

Confidence

in UK financial sector drops to lowest since 1990

Hedge

funds bet on fall in UK house prices

US:

housing market frozen - recession likely says Freddie Mac

US:

2.5m households' mortgages likely to reset at around 10%

Banks

tighten lending as their own borrowing costs rise

Bank

of England not so independent of government after all

Assurances

fail to halt run on UK mortgage lending bank

UK

property crash possible says RICS's chief economist

Greenspan:

Double digit interest rates on the way

Greenspan:

UK mortgage holders will experience 'difficulties'

16

Sep: UK housing market's bull run comes to an end

The

average asking price for a UK home fell in September

Ninth

consecutive monthly drop in new house buyer inquiries

Fear

of retail bloodbath as rising interest rates hit home

Average

standard variable UK mortgage rate rises to 7.69%

Rising

mortgage costs encourage London landlords to sell

Britons

seeking debt advice hits a record

Unemployment

rises in US - 12,000 home lender jobs to go

UK house prices

1997-06 rose 4 times faster than average pay

UK

mortgage rates will rise as bank borrowing costs rise

UK

media provides late advice on surviving a housing crash

Mortgage

eats 51% of young London couples' post-tax income

Major

Landlord says UK buy-to-let figures no longer add up

"Release

cash in your home while you've still got time"

A nation (re)possessed?

[The vultures close in...]

Higher

UK mortgage rates hit lower income earners

Young

homebuyers contend with £20k additional debt

Filings for

repossessions in US up 93% vs a year ago

'slow

down in [UK] house price inflation could turn into a slump'

New

house buyer enquiries down and unsold stock up (July)

Near

1m UK buy-to-let mortgages now, up x 33 from 28k in '98

10

Aug: The parties over - City hit by biggest crisis in 10 years

10

Aug: stock markets tumble as sub-prime contagion spreads

BNP

freezes funds in sub-prime shock

UK

property fund outflows surge

Bank

of England signals interest rates rise to 6% and beyond

Repossessions

up 30% on 12 mths ago as squeeze continues

City

millionaires are sending UK farmland prices soaring

UK's

house prices are second most overvalued

US:

housing suffering its worst recession since 1992

Houses

now account for 60% of UK's 'wealth' - a record high

Of

179 properties at Covent Garden auction, 52 reposessed

Oversupply

of houses for sale creates buyers market in UK

UK

mortgage lenders call for interest rate freeze

Americans

could default to the tune of $100bn

2

European Insurers face $8bn of sub-prime mortage exposure

UK

commercial property funds start to nosedive

How

US borrowers were caught out

720,000

expected to have home repossessed this year in USA

Twice

as many Brits missing mortgage payments as in 2006

UK

housebuilders hit by stagnating house market

US

sub-prime mortgage ills infect UK markets

First

time buyers spend up to 48% of income on debt repayment

200

businesses launched to capitalize on UK mortgage arrears

FSA

sounds alarm on UK sub-prime lending

London

house price rises mask falls elsewhere

UK household

disposable income dips below last 1990 low

UK

housing market sentiment 'may' be turning, survey warns

UK's

personal savings rate hits 47 year low

US:

mortgage defaults already at highest level in 37 years

Are the planners really to

blame for lack of affordable housing?

Bubbling

under...unsold homes lead to unlet homes lead to...

Housebuilding

market 'may not' be working well for consumers

US:

average mortgage interest rate hits 6.74% in June 07

Cheap

fixed-rate mortgage will end for 2m Brits later this year

£1,300,000,000,000

in debt

Housebuilders

own enough unused land to build 225,000 homes

ABN

fears world housing crash

First-time

buyers in UK face highest mortgage costs in 15 years

Bonds

sell-off suggests rising interest rates are here to stay

The

return of negative equity?

The

C-word that remains taboo

Repayment

shock ahead as 2-3yr fixed mortgage periods expire

Buy-to-let

landlords start sell-off as demand dries up

May

07 - house prices freeze or fall in 2/3 of UK districts

Do

we need a housing market crash in the UK?

How developers maintain

profitability as land prices inflate

UK buy-to-let has grown

by factor of 26 since 1998 (c.section 6)

UK

homebuyers now at full stretch

2020 Vision to end the boom & bust

cycle

How

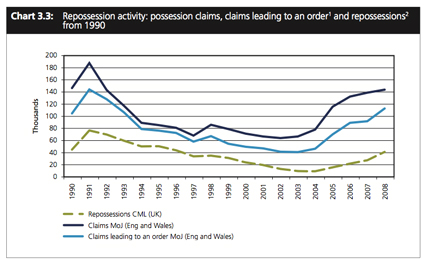

soon will UK repossessions hit their 1991 peak of 75,540?

Spain: property

firm shares plunge 60% in 6 days

Loan

standards for buy-to-let slide

Up

to our eyes in debt we can't see

Fixed

mortgage deals vanish as UK inflation rises

'Buy

to leave' investors keep thousands of homes empty

Property

prices 15 times earnings in London

UK Faces £459BN

Housing Crash

France:

housing bubble set to burst

US:

housing slump may set off full-scale global crisis

World stocks

tumble on US fears

US: repossessions

hit their highest in 37 years

US:

mortgage crisis goes into meltdown